Grief Counseling Resources

Help for You When You Need it MostNavigating the Loss of a Loved One

At Michaels, you are our number one priority and we are here to help when you need it most. This page provides an overview of the grief counseling resources and services available to full-time Team Members and family members navigating the loss of a loved one.

Filing Claims After a Loss

If you and/or members of your family are experiencing the loss of a loved one, please reach out to a Benefits Partner for assistance in getting a life insurance claim processed with Reliance Matrix.

To begin this process, open a Knowledge Zone ticket with any questions regarding your life claim and a Benefits Partner will contact you about your claim and next steps.

Guidance for Filing Claims with Reliance Matrix

How-To Guides

- Easy Access Claims Filing - Process flow overview for filing claims with Reliance Matrix.

- Filing Claims with Reliance Matrix - Applies to Leave of Absence (LOA), Disability, and Voluntary benefits.

- How to File Claims for Short-Term Disability (STD) & Family Medical Leave of Absence (FMLA)

- How to File Claims for Voluntary Accident, Hospital Indemnity & Critical Illness

- Download the Matrix eServices App

Important Note About Claims for Kaiser Members

Team Members who are enrolled in a Kaiser medical plan must complete an authorization release form in order to file a claim with Reliance Matrix.

- Reliance Matrix will provide you with the authorization release form to sign and return.

- This form is required in order for Reliance Matrix to obtain the required medical certification from your physician.

- Failure to provide the signed authorization release form to Reliance Matrix will result in your claim being denied.

Life & AD&D Insurance

All full-time Team Members, regardless of whether they enroll in a medical or dental plan, will receive Basic Life Insurance at no cost to them. Additionally, Michaels offers Team Members with the opportunity to enroll in Optional Life and Optional Accidental Death & Dismemberment (AD&D) Insurance. Please reach out to a Benefits Partner by opening a Knowledge Zone ticket for more information regarding these benefits for you and your spouse or domestic partner.

- Employee Life: $25,000

- Employee AD&D: $25,000

- Employee Spouse/Domestic Partner: $2,000

- Employee Child: $1,000

(blank)

Updating Your Benefits After Loss

If you experience a qualifying life event such as the loss of a loved one, you will have 30 days following the date of the life event to make changes to your benefit elections, and this change in status must be consistent with the life event.

You will first need to update your dependents in Workday before completing the qualifying life event.

Some documentation may be required with your request: an acceptable form of documentation would be a death certificate that details the date of passing of a loved one.

Changing Your Beneficiaries

Your beneficiaries are managed in Workday. To update your beneficiaries, follow the steps below.

- Log in to Workday.

- In the top left-hand corner, select Menu > Benefits. Then, select Pay > Benefits > Change Benefits.

- This will allow you to launch the “Assign Beneficiaries” task where you can remove or add beneficiaries to your current elections.

Requesting Leave (LOA)

We understand that grief can be difficult for you and your family, and you may require more time away from work to dedicate to your loved ones following a loss.

Consider requesting a Leave of Absence (LOA) if you plan to be away from work for longer than a week. You can request leave if you’re going to be absent from work for more than five (5) consecutive working days due to a personal, medical, or other reason.

Read the Michaels Leave of Absence (LOA) Guide and visit the LOA page for more detailed information about requesting leave. To initiate a request, call Reliance Matrix at 1-888-288-1354.

Employee Assistance Program (EAP)

The Employee Assistance Program (EAP) is a free, confidential resource available for you and your family – even if you’re not enrolled in any Michaels benefit plans.

The EAP includes counseling services for all Michaels Team Members:

- Full-time Team Members are eligible to receive up to three (3) face-to-face or tele-video counseling sessions per issue at no charge.

- Part-time Team Members are not eligible for face-to-face counseling sessions but are eligible to receive confidential counseling by phone at any time.

There are three ways for you to find more information and access EAP resources:

- Visit the EAP page.

- Log in to the Resources for Living member portal with the username Michaels and password 8002835645.

- Call 1-800-283-5645 (TTY 711).

Supportiv

Supportiv is an online tool that lets you talk through any mental health, emotional, or social struggles in small group chats with people who can relate. Discussions are anonymous and are guided and safeguarded in real time by professional facilitators. Supportiv is anonymous and available 24/7.

Visit the Supportiv page for program information, resources, and on-demand webinars.

Michaels CARES

Michaels CARES is a 501(c)(3) charity that helps Michaels Team Members, including by providing financial assistance in the event of the death of a Team Member or eligible family member(s).

To request assistance, make sure you meet the requirements below and then complete the application.

Here’s a quick checklist to follow when you apply:

- Application must be completed in its entirety.

- Sponsor must sign the application (sponsors are a critical part of our process).

- Supporting documents are attached – more is better.

Have questions? Read the Michaels CARES FAQs and visit the Michaels CARES page for more information regarding this benefit.

PerkSpot Wellness

PerkSpot Wellness offers various discounts on emotional wellness services that support your mental health, offering deals on therapy, meditation, yoga, and more. Perkspot partners with reputable online counseling services like BetterHelp and Talkspace.

Visit michaels.perkspot.com to access these resources and find additional information about this benefit in the PerkSpot section of the Benefit Extras & Discounts page.

COBRA

Death is a qualifying life event. If you or your spouse/domestic partner are covered on Michaels medical, dental, vision, and/or flexible spending account (FSA), you will receive a COBRA notice that allows your continued participation in a Michaels medical program for up to 18 months.

You will receive the COBRA notice in the mail that details your coverage options from Taben, our COBRA administrator.

For more information, please reach out to the Taben Group at 800-675-7341.

If you would like an electronic copy of the CORBA notice, please reach out to Team Member Services by opening a Knowledge Zone ticket.

UBS Financial Wellness Resources

For Support Center-Based Team MembersEmpower Your Future with UBS Financial Wellness

Michaels has partnered with UBS; a global wealth management and banking institution to offer eligible Team Members a wide range of information, guidance and educational support services designed to assist you in navigating your financial journey with confidence.

Whether you’re looking for personalized advice, self-guided tools, or educational events, UBS Financial Wellness can help you with the right tools to manage your money.

Continuing our commitment to your overall well-being, UBS will be offering:

- Personalized Financial Coaching

- Digital Tools and Educational Resources

- Financial Education Webinars

Who's Eligible?

At launch, full-time and part-time Support Center-based Team Members will have access to this benefit from UBS.

Services Offered

Personalized Financial Coaching

Gain clarity and confidence with a complimentary, confidential call with a UBS Financial Coach. These professionals are available to answer your financial questions, review your unique situation, and provide tailored guidance. Whether you need help with budgeting, saving, or planning for the future, UBS Financial Coaches are ready to assist.

To schedule your session, follow the link below or call 888-346-9355.

Digital Tools & Educational Resources

Access a wealth of knowledge through the UBS Financial Wellness digital platform, offering interactive tools, calculators, and content tailored to your personal financial goals. This resource is designed to empower you to take control of your financial future on your own terms.

To get started, you’ll need to register with your Michaels employee ID. You can find that by visiting your profile in Workday. It’s the number next to or under your name.

Financial Education Webinars

Stay informed with our virtual webinar series. Each session will feature UBS Financial Coaches and/or guest speakers discussing essential topics to help you make informed decisions about your finances.

Estate Planning Made Easy

Plan for the future with Trust & Will, a digital estate planning platform that makes it simple to create a comprehensive estate plan from home. You can create a trust, will, or both. When you’re ready to finalize your plan, there is a fee to file your legally binding documents. This fee is discounted 25% for eligible Michaels Team Members.

Nobody wants to imagine their pet getting sick or injured, but when it comes to your pet’s health, it’s best to expect the unexpected. When you enroll in Pet Health Insurance, administered by Wishbone, you will receive a 70% reimbursement on your pet’s veterinary care after meeting the $250 deductible. Protecting your pet’s health and your finances has never been easier!

Wishbone Pet Insurance is accepted at any vet in the U.S., including emergency hospitals. Once you file a claim, you can expect a fast reimbursement via a mailed check.

This benefit will not be set up as a payroll deduction but instead by credit card payment through Wishbone.

Upcoming Webinar

Register for our next webinar on June 24, 2024, at 2 p.m. CT.

During the event, we’ll cover more about your UBS financial wellness benefit and get to know your UBS Financial Coaches. We’ll discuss:

- Why financial wellness is important.

- Your UBS Financial Wellness resources.

- Your Financial Coaches and how they can help.

- Next steps to get you started.

Provider

UBS Financial Wellness

Reliance Matrix Benefits Overview Video

Leave, Disability & Voluntary Benefits

Open Enrollment Webinar Presentation Video

Mercer Health Advantage (MHA) Program

This program is for Team Members enrolled in a BCBSTX medical plan.

Health Care Help for You

Sometimes managing your health requires more than doctor visits, lab tests, and prescriptions. Blue Cross and Blue Shield of Texas (BCBSTX) makes it easier than ever for you to get the most from your health plan benefits. Your health plan includes the Mercer Health Advantage program, which offers specialized training and support from Personal Health Clinicians and Benefits Value Advisors (BVAs).

To reach a Personal Health Clinician or BVA, simply call the number on the back of your member ID card.

Program Overview

(blank)

Personal Health Clinicians

Personal Health Clinicians* are trained to help with your health and benefit questions, concerns, and more. Each clinician is backed by a team of health specialists, including behavioral health clinicians, social workers, and a pharmacist.

A Personal Health Clinician* can help you:

- Keep up with doctor’s appointments and other care-related activities.

- Review your doctor’s instructions.

- Coordinate your care needs after an illness, procedure or surgery.

- Know what to expect if you spend time in the hospital.

*Talking with a Personal Health Clinician is not a substitute for medical advice. Care and treatment decisions are between you and your health care provider. If you are having a medical emergency, call 911.

Benefits Value Advisors (BVAs)

Available 24 hours a day, seven days a week, Benefits Value Advisors (BVAs) partner with dedicated Personal Health Clinicians to help you get the most from your benefits. BVAs can help you get costs for providers and procedures, assist with referrals and prior authorizations, schedule appointments and more.

Know Your Benefits

24/7 Nurseline

- Answers general health questions

- Helps you decide where to get care

Behavioral Health

- Covers treatment for anxiety, stress and depression

- Helps with substance use and eating disorders, autism and other conditions

Fitness Program

- A choice of gym networks to fit your budget and preference

- Different membership options2 to best meet needs and preferences

- Provides discounts at 40,000 well-being providers nationwide

Women’s and Family Health

- Ovia®, Ovia® Pregnancy, or Ovia™ Parenting Apps

- Helps with high-risk pregnancies

- Support from maternity specialists

Stay in Touch with BCBSTX

You can decide how you want Blue Cross and Blue Shield of Texas (BCBSTX) to contact you about your health plan benefits. Below are three quick steps to take now to make using your health plan easier. This way, when you need to use your benefits, you’ll be ready to go.

Step 1: Put the BCBSTX phone number in your contact list.

- You can reach a BCBSTX Personal Health Clinician or Benefits Value Advisor (BVA) by calling the number on the back of your member ID card.

- Personal Health Clinicians can answer questions about your health insurance and help you navigate the health care system. A BVA can help you get costs for providers and procedures, assist with referrals, schedule appointments, set up pre-authorizations and more.

- Put this number in your phone contact list now!

Step 2: Tell BCBSTX how you want to stay in touch.

- Add or update your contact preferences by visiting upp.bcbstx.com.

- This way, BCBSTX will know how to reach you with important benefits and health information.

Step 3: Download and use the BCBSTX app to find a doctor, access your digital ID card, and more. To download, just text BCBSTXAPP to 33633.

Nobody wants to imagine their pet getting sick or injured, but when it comes to your pet’s health, it’s best to expect the unexpected. When you enroll in Pet Health Insurance, administered by Wishbone, you will receive a 70% reimbursement on your pet’s veterinary care after meeting the $250 deductible. Protecting your pet’s health and your finances has never been easier!

Wishbone Pet Insurance is accepted at any vet in the U.S., including emergency hospitals. Once you file a claim, you can expect a fast reimbursement via a mailed check.

This benefit will not be set up as a payroll deduction but instead by credit card payment through Wishbone.

Helpful Resources

Provider

Blue Cross & Blue Shield of Texas (BCBSTX)

Medical Insurance (PPO & HSA)

Contact Information

Phone: 1-877-269-1180

Quick Links

Pet Health Insurance

Prepare for the Unexpected with Your Pet's HealthWishbone Pet Health Insurance

Plan Information

Nobody wants to imagine their pet getting sick or injured- but when it comes to your pet’s health, it’s best to expect the unexpected.

Enroll in pet health insurance from Wishbone and receive 70% reimbursement on your pet’s veterinary care. With a low deductible of $250, protecting your pet’s health and your finances

has never been easier!

Wishbone Pet Insurance is accepted at any vet in the U.S., including emergency hospitals. Once you file a claim, expect fast reimbursement via mailed check. It’s that easy!

Nobody wants to imagine their pet getting sick or injured, but when it comes to your pet’s health, it’s best to expect the unexpected. When you enroll in Pet Health Insurance, administered by Wishbone, you will receive a 70% reimbursement on your pet’s veterinary care after meeting the $250 deductible. Protecting your pet’s health and your finances has never been easier!

Wishbone Pet Insurance is accepted at any vet in the U.S., including emergency hospitals. Once you file a claim, you can expect a fast reimbursement via a mailed check.

This benefit will not be set up as a payroll deduction but instead by credit card payment through Wishbone.

Provider

Pet Benefit Solutions

Voluntary Hospital Indemnity Insurance

Voluntary Hospital Indemnity Insurance

Plan Information

Hospital Indemnity Insurance, administered by Reliance Matrix, provides a range of fixed, lump-sum daily benefits to help cover costs associated with a hospital admission, including room and board costs. These benefits are paid directly to the insured following a hospitalization that meets the criteria for benefit payment.

Voluntary Hospital Indemnity Insurance Plan Highlights: English | Spanish

Voluntary Hospital Indemnity Insurance, administered by Reliance Matrix, provides a range of fixed, lump-sum daily benefits to help cover costs associated with a hospital admission, including room and board costs. These benefits are paid directly to you following a hospitalization that meets the criteria for benefit payment.

If you are newly eligible to enroll in benefits, you can elect Hospital Indemnity Insurance coverage up to the Guarantee Issue without answering any health questions. Otherwise, you will be required to provide Evidence of Insurability (EOI) and be approved by Reliance Standard before coverage begins.

Voluntary Hospital Indemnity Insurance Plan Highlights: English | Spanish

(blank)

Eligibility

All benefits-eligible full-time Team Members and covered dependents are eligible for Hospital Indemnity Insurance.

Dependents can include:

- Your legal spouse or domestic partner.

- Your dependent children from birth to 26 years.

A person may not have coverage as both a Team Member and a dependent.

Biweekly Premiums

| Coverage | Premium – High |

Schedule of Benefits

| Benefits | Amount |

| Hospital Room & Board | $100 per day (30 daily benefits per plan year*) |

| Hospital Critical Care Unit | $200 per day (15 daily benefits per plan year) |

| Hospital Admission & Observation | $1,000 (2 daily benefits per plan year) |

| Hospital Critical Care Admission | $2,000 (1 daily benefit per plan year) |

| Wellness Care** | $50 (1 daily benefit per plan year) |

| On-Call Travel Assistance Services | Included |

*In no event will the Daily Benefits exceed 30 daily benefits per Coverage Year.

**Wellness Care means medical examinations and procedures that are preventive in nature and not for the treatment of Injury or Sickness.

Features

- Guaranteed issue; no medical questions

- No pre-existing conditions exclusions

- Mental & Nervous and Substance Abuse treated same as any

other hospital admission - No deductibles

- Eligible for continuation of coverage

- HIPAA privacy compliant

- Overlying Major Medical Plan NOT Required*

- Coverage Offered on a Voluntary Basis

Video Overview of Leave, Disability & Voluntary Benefits

Get Support

For assistance, contact Team Member Services at 855-432-MIKE (6453) and select option 2, available Monday through Friday from 8 a.m. to 5 p.m. CT. You can also open a Knowledge Zone support ticket.

File Your Claim(s) Online with Reliance Matrix

Guidance for Filing Claims with Reliance Matrix

How-To Guides

- Easy Access Claims Filing - Process flow overview for filing claims with Reliance Matrix.

- Filing Claims with Reliance Matrix - Applies to Leave of Absence (LOA), Disability, and Voluntary benefits.

- How to File Claims for Short-Term Disability (STD) & Family Medical Leave of Absence (FMLA)

- How to File Claims for Voluntary Accident, Hospital Indemnity & Critical Illness

- Download the Matrix eServices App

Important Note About Claims for Kaiser Members

Team Members who are enrolled in a Kaiser medical plan must complete an authorization release form in order to file a claim with Reliance Matrix.

- Reliance Matrix will provide you with the authorization release form to sign and return.

- This form is required in order for Reliance Matrix to obtain the required medical certification from your physician.

- Failure to provide the signed authorization release form to Reliance Matrix will result in your claim being denied.

Reliance Matrix

Disability, Life & AD&D, Accident, Critical Illness, Hospital Indemnity Insurance

Contact

Phone: 1-855-RSL-CLAIM (775-2524)

Benefits Enrollment Resources

Benefits Information for HR & People LeadersOpen Enrollment Period:

May 6–17, 2024

Benefits Plan Year:

July 1, 2024 - June 30, 2025

Prepare for the New Benefits Plan Year

What Team Members Can Do

Open enrollment for the 2024-2025 benefits plan year is May 6–17, 2024. During this annual open enrollment period, Team Members are encouraged to review their benefit options, coverage information, and rate changes taking effect with the new plan year starting July 1, 2024.

Team Members don’t have to do anything to keep their current coverage. However, they MUST complete enrollment to:

- Change their current benefit elections

- Add or remove covered dependents

(blank)

If you do not take action during the annual open enrollment period, your current benefit elections will continue at the new 2024-2024 rates for the 2024-2025 plan year, which begins on July 1, 2024 and ends on June 30, 2025.

You can only change your benefit elections outside the annual open enrollment period if you experience a qualifying life event. For more information about qualifying life events, please visit this link: Change in Status.

What Happens If Team Members Don't Take Action

If Team Members do not take action during the annual open enrollment period, their current benefit elections will continue at the new 2024-2025 rates for the 2024–2025 plan year.

Team Members can only change their benefit elections outside the annual open enrollment period if they experience a qualifying life event. For more information about Qualifying Life Event, please visit this link: Change in Status.

FSA & HSA Elections

Team Members will have the opportunity to make Flexible Spending Account (FSA) and/or Health Savings Account (HSA) elections in October 2024 for the 2025 calendar year. Outlined below are scenarios that might apply to Team Members.

| Scenario | Flexible Spending Account (FSA) | HRA (part of Kaiser medical plan) | Health Savings Account (HSA) |

|---|---|---|---|

| Enrolled in the PPO Plan and switch to the HDHP Choice HSA 7/1/2024 | Required to move from full FSA to Limited Purpose FSA if previously enrolled in full FSA (can't have HSA and full FSA). | Cannot enroll. | Can start contributing to HSA. |

| Enrolled in HDHP Choice HSA and switch to the PPO medical Plan 7/1/2024 | If enrolled in Limited Purpose FSA, have the option to switch to the full FSA but not required. | Cannot enroll. | Required to stop contributing to HSA. |

| Enrolled in PPO Plan and stay in this plan 7/1/2024 | If enrolled in Full FSA, will not be able to make changes to this plan until October 2024 for a 1/1/2025 effective date. If enrolled in Limited Purpose FSA already, will need to keep current election. They can then make changes to this plan in October 2024 for a 1/1/2025 effective date. | Cannot enroll. | Cannot enroll. |

| Enrolled in HDHP Choice HSA and stay in this plan 7/1/2024 | Can keep current Limited Purpose FSA, will not be able to make changes to this plan until October 2024 for 1/1/2025 effective date. | Cannot enroll. | Can change election amount anytime throughout the year. ER HSA contribution should continue as long as they are enrolled in Choice HSA Medical. |

| Enrolled in Kaiser and keep Kaiser medical plan 7/1/2024 | Enrolled in FSA plan, keep current enrollment. Will need to wait until October 2024 to elect for 1/1/2025. If not currently enrolled in FSA, they will need to wait until October 2024 to elect for 1/1/2025. | HRA election will continue. | Cannot enroll. |

| Enrolled in Kaiser HRA medical and moves to PPO Plan 7/1/2024 | Enrolled in FSA plan, keep current enrollment. Will need to wait until October 2024 to elect for 1/1/2025. If not currently enrolled in FSA, they will need to wait until October 2024 to elect it for 1/1/2025. | HRA election will stop. | Cannot enroll. |

| Enrolled in Kaiser HRA medical and moves to HDHP Choice HSA 7/1/2024 | Required to move from full FSA to Limited Purpose FSA if previously enrolled in full FSA (can't have HSA and full FSA). | HRA election will stop. | May start contributing to HSA. |

(blank)

What's New for 2024-2025

Slight Cost Increases

- Health care costs continue to rise. We’re committed to providing you with high-quality services with a range of medical plans to fit your needs. This year, you’ll see changes to deductibles, out-of-pocket maximums, coinsurance, and copays for the BCBSTX Enhanced PPO and Choice HSA plan. You’ll also see varying increases to premiums on all medical plans. We continue to share the cost of health care for you and your family, with Michaels absorbing approximately 75-80% of the cost of coverage.

- Wellness and tobacco surcharges will increase from $25 per paycheck to $30 per paycheck. Make sure Team Members and their covered spouse/domestic partner complete a preventive wellness exam between July 1, 2023, and June 30, 2024. They’ll avoid a $30 per paycheck surcharge per person on their medical premiums. If they are enrolled in a Michaels BCBSTX plan, they also have the option to use VirtualCheckup through Catapult Health.

- Team Members can use the eValuate tool to choose the medical plan that makes the most sense for them and their families. The more Team Members know about the available choices, plans, and features, the easier it is to select and use their benefits wisely.

Prescription Drugs

New! For no additional cost, eligible Team Members can take advantage of the Specialty Drug Split-Fill program to try a partial quantity of a newly prescribed specialty drug before the full month’s supply is filled.

Hospital Indemnity

New! Eligible Team Members have the option to enroll in Voluntary Hospital Indemnity coverage that pays a direct cash benefit in the event of a hospital stay.

Pet Insurance

New! Eligible Team Members can enroll in Wishbone pet insurance. Premiums can be paid with a credit card.

Wellness & Tobacco Surcharges

Team Members can avoid surcharges and higher premiums for medical coverage by fulfilling the wellness exam requirement and qualifying as tobacco-free.

- The wellness surcharge is $30 per person, per paycheck. To avoid this surcharge for 2024–2025 plan year, Team Members (and, if covered, their spouse/domestic partner) will want to make sure they complete an annual physical exam between July 1, 2023 and June 30, 2024. Team Members enrolled in a BCBSTX medical plan also have the option to complete their wellness exam requirement by using the VirtualHealth Checkup through Catapult Health, and there is no charge for this service.

- The tobacco surcharge is $30 per person, per paycheck. To avoid this surcharge for the 2024–2025 plan year, Team Members (and, if covered, their spouse/domestic partner) must be tobacco-free for at least six months leading up to the date they enroll in benefits. Tobacco cessation programs are available to team members free of charge through any Michaels medical plan.

For more detailed information and instructions on how to ensure these surcharges don’t apply to them, Team Members can visit this link: Wellness Programs & Surcharges.

Open Enrollment Meetings & Webinars

All scheduled webinars and live meetings have passed.

Were you unable to attend a scheduled webinar or live meeting? Watch the recorded version below. Want to review the presentation document? Download the digital version below.

Unable to attend a scheduled webinar or live meeting? Watch the recorded version below. Want to review the presentation document? Download the digital version below.

Team Member Communications

For your reference, digital copies will be posted below of all communications sent to benefits-eligible Team Members regarding open enrollment for the 2024–2025 plan year.

Begin Enrollment

Log in to Workday

Open the Demo Video

Workday Job Aids

- How to Enroll in Workday: English | Spanish

- How to Add Dependents in Workday: English | Spanish

- Other: Accessing Workday on LOA

Know Where to Go for Answers

Call Team Member Services at 855-432-MIKE (6453), option 2, or submit a ticket through Knowledge Zone.

Choose Wisely — No Changes After Enrolling!

Changes to your benefit elections are only allowed outside of the open enrollment period if you have a qualifying life event, such as a birth, adoption, marriage, or divorce. Changes in status must be made within 30 days of the qualifying life event. For more information, follow this link: Change in Status.

Wellness Programs & Surcharges

Be Proactive with Your Wellness & Avoid SurchargesWellness at Michaels

Good health improves virtually every aspect of our personal and professional lives, and that’s good for you and for Michaels. Our wellness programs focus on more than just your physical health: they challenge you to be mentally, emotionally, and financially healthy, too. Whether your goal is to lose weight, be more proactive with your health, eat healthier, or save more, we’ve got you covered.

Benefits Plan Year: The plan year for Michaels benefits coverage begins on July 1 and ends on June 30, regardless of when you are hired.

Important Note

If you think you might not be able to meet a wellness or tobacco-use standard, resulting in a surcharge being added to your annual medical premium, you may qualify through other means. For further assistance, please call 1-855-432-MIKE (6453) and we will work with you – and if you wish, with your doctor – to find a reasonable alternative.

Wellness Exam Surcharge

Team Members and their spouse/domestic partner enrolled in a Michaels full-time medical plan are subject to an annual preventative wellness requirement, with the potential to waive wellness surcharges and lower annual premium costs.

Completing an annual physical exam during the current plan year will satisfy the wellness requirement and waive the surcharge for the next plan year.

Surcharge Rate

- If you and your spouse/domestic partner do not satisfy the wellness requirement, you will pay a surcharge of $30 per person, per paycheck, totaling $780 per person for the 2024-2025 plan year (previously $25 per person, per paycheck, totaling $650 per person for the 2023-2024 plan year).

- For coverage beginning on or before March 1, 2024, you must complete your wellness activity between July 1, 2023 and June 30, 2024.

(blank)

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

How to Have Your Wellness Surcharge Waived

To satisfy the wellness requirement, you (and if applicable, your spouse or domestic partner) must:*

First, complete a physical exam between July 1 and June 30 in one of two ways:

- Schedule an appointment with your primary care physician (PCP).

- Blue Cross & Blue Shield of Texas (BCBSTX) members can use the Catapult Health VirtualCheckup® Home Kit – the cost is 100% covered by Michaels! For more details, refer to the section below.

Then, submit your proof of exam documentation to insurance to waive your surcharge for the following plan year.

*If you were hired July 1 or later in the current plan year, please refer to the next section for information about one-time exceptions for new hires.

Example: You complete your annual physical exam on Aug. 2, 2023 and submit proof of your exam to insurance on Jan. 12, 2024, satisfying the wellness requirement. As a result, your surcharge is waived for the next plan year that goes from July 1, 2024 through June 30, 2025, lowering your annual premium cost for that plan year.

| 2023-2024 Plan Year | 2024-2025 Plan Year | |

|---|---|---|

| July 1, 2023 – June 30, 2024 | July 1, 2024 – June 30, 2025 | |

| Aug. 2, 2023 | Jan. 12, 2024 | Surcharge Waived (No wellness surcharge on next year's premium) |

| Annual Physical Exam | Submit Proof of Exam to Insurance | |

Exceptions for New Hires

There are exceptions to the wellness requirement for Team Members who begin their employment with Michaels after the current benefits plan year has already begun.

For new hires, benefits are effective the first day of the month following the Team Member’s date of hire.

For a Benefit Effective Date of March 2, 2024 or Later

- You are exempt from the wellness requirement for the current plan year (through June 30) and for the upcoming plan year (from July 1 through June 30), and this surcharge will automatically be waived.

- The above also applies to your spouse or domestic partner, if enrolled as your dependent.

Example: If your hire date was Feb. 15, 2024, your benefits will be effective on April 1, 2024, and you (and if applicable, your spouse or domestic partner) will not be required to satisfy the wellness requirement.

For a Benefit Effective Date from July 1, 2023 – March 1, 2024

- You will be required to satisfy the wellness requirement in order to have your surcharge waived for the current plan year (through June 30) and for the upcoming plan year (from July 1 through June 30).

- To satisfy the wellness requirement, you can submit proof of your physical exam that was completed:

- with another provider prior to your employment with Michaels, and

- no earlier than July 1 of the year leading up to your employment with Michaels.

- The above also applies to your spouse or domestic partner, if enrolled as your dependent.

Example: You start working at Michaels on Oct. 15, 2024. You have a physical exam on Aug. 2, 2024. On Jan. 12, 2025, you submit proof of your exam, satisfying the Wellness Requirement and waiving your surcharge for the current plan year.

| 2024-2025 Plan Year | ||

|---|---|---|

| July 1, 2024 – June 30, 2025 | ||

| Aug. 2, 2024 | Oct. 15, 2024 | Jan. 12, 2025 |

| Annual Physical Exam | First Day of Work | Submit Proof of Exam to Insurance |

| Surcharge Waived (No wellness surcharge on current plan year's premium) |

||

No-Cost VirtualCheckup® for BCBSTX Members

If you are enrolled in a BCBSTX medical plan, Michaels provides a convenient annual checkup at no cost to you using the Catapult Health VirtualCheckup® Home Kit. Getting a FREE preventive health checkup has never been easier, and a Catapult virtual exam counts toward your wellness requirement!

All covered employees and their spouse or domestic partner can register for a Home Kit. The cost of your VirtualCheckup® is covered 100% by Michaels.

Once you complete your Home Kit, you will review your results with a board-certified Nurse Practitioner via a virtual consultation and develop a personal action plan.

Additional Information

Next Steps for BCBSTX Members

Your wellness exam claim will automatically be processed by BCBSTX after your appointment. Once processed, your exam completion status will be reflected in the Well onTarget section of the BlueAccess for Members portal. In the portal, you can also access other historical data about your participation in the available wellness programs.

If you have any questions regarding wellness completion within the BCBSTX portal, please contact BCBSTX customer service at 1-877-269-1180.

Refer to the job aid below for instructions on how to log in to the BlueAccess for Members portal to confirm the status of your wellness requirement.

Job Aid

- How to Confirm the Status of Your Wellness Requirement: Desktop | Mobile App

Next Steps for Kaiser Members

Once you have scheduled your wellness exam with your primary care physician (PCP), log in to the US Wellness portal to download/print the Physician Form and take it to your appointment.

After your appointment, upload the completed Physician Form to the US Wellness portal by June 30. You can upload the form using your desktop, tablet, or mobile device. Receipt of your form will be confirmed within two (2) business days to the email address provided at the time of upload.

Refer to the job aid below for instructions on how to download/print your Physician Form and upload your completed document in the US Wellness portal to complete your wellness requirement.

Job Aid

For assistance with this process, email US Wellness at support@uswellness.com or call 888-926-6099 ext. 900.

Tobacco Surcharge

Team Members and their spouse/domestic partner enrolled in a Michaels full-time medical plan are encouraged to be tobacco-free to waive tobacco surcharges and lower annual premium costs.

If you are considered tobacco-free, your tobacco surcharge will be waived for the current plan year.

Surcharge Rate

If you and your spouse/domestic partner are not considered tobacco-free, you will pay a surcharge of $30 per person, per paycheck, totaling $780 per person for the 2024-2025 plan year (previously $25 per person, per paycheck, totaling $650 per person for the 2023-2024 plan year).

(blank)

How to Have Your Tobacco Surcharge Waived

You will select your tobacco-free or tobacco-use status when you enroll in your benefits each year, and you can only update your status during the enrollment period.

To be considered tobacco-free, you can’t use tobacco products for at least six (6) months. Tobacco use includes the use of e-cigarettes and non-nicotine vaporizers.

Tobacco Cessation Program

A Tobacco Cessation Program is available for Team Members who are enrolled in a BCBSTX medical plan. Choose an option below to access additional information about the program.

- Log in to your BCBSTX account.

- Visit the Well onTarget website and either register for an account or log in using your BCBSTX credentials.

What is Supportiv?

Program Information & Resources

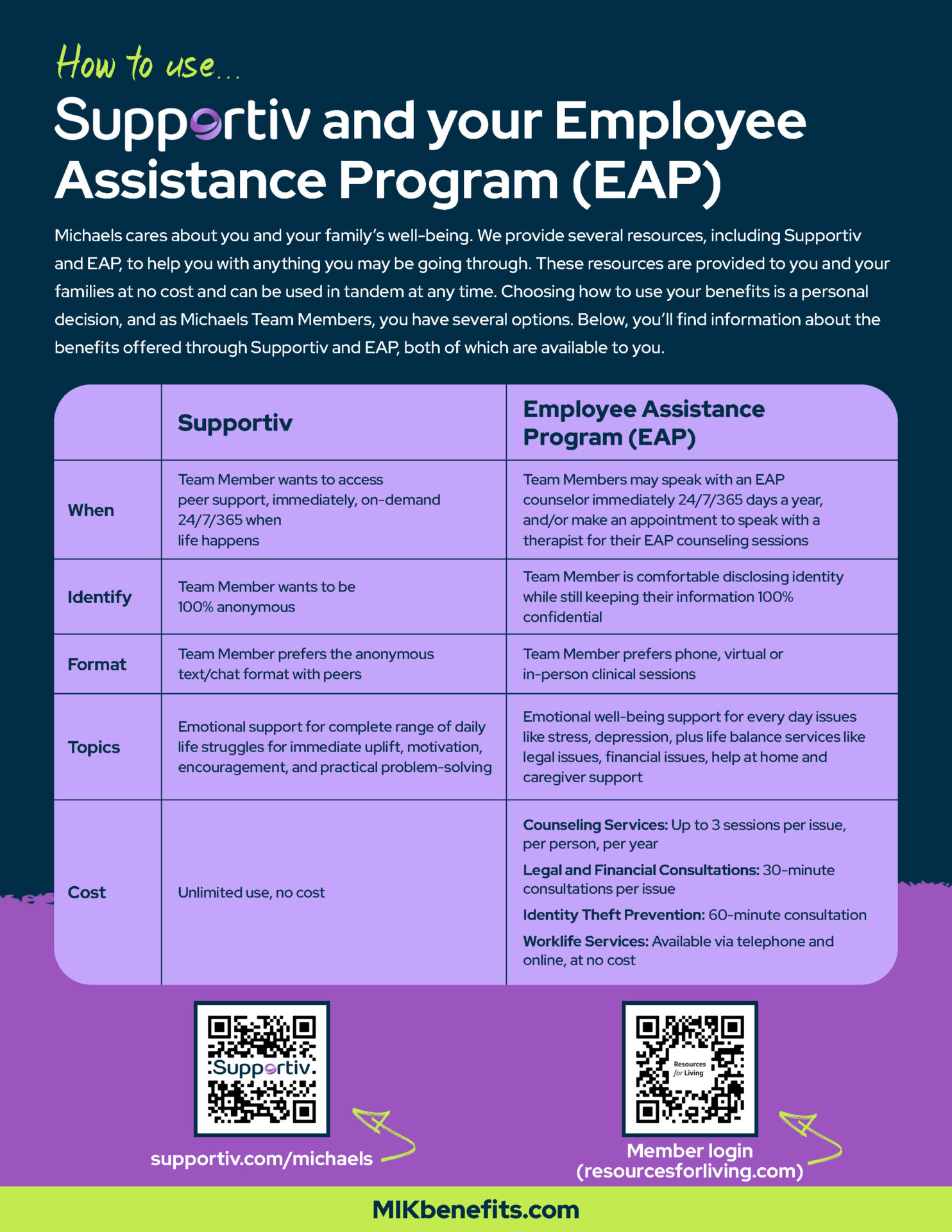

Through the Michaels Employee Assistance Program (EAP), you have unlimited access to Supportiv, an online peer support service that can help you cope with stress, work, family issues, loneliness, anxiety, parenting, motivation, and more.

Supportiv is an online tool that lets you talk through any mental health, emotional, or social struggles in small group chats with people who can relate. Discussions are anonymous and are guided and safeguarded in real time by professional facilitators. Supportiv is anonymous and available 24/7.

(blank)

Supportiv is for Everyone

Supportiv is offered through the Aetna Resources for Living Employee Assistance Program (EAP), which is available 24/7 to all Michaels Team Members and their household members. Services are free of charge and completely confidential.

Get Started with Supportiv

Supportiv is free to use at your convenience, there’s no need to enter any personal information, and you’ll be live chatting in about 30 seconds.

- Visit Supportiv and select the “Chat Now” button.

- Submit your question or challenge.

- Get matched with peers to chat with, and receive guidance and hyper-targeted recommendations from a professional facilitator.

In the event of an emergency, please call 911. Additional crisis and emergency resources can be found by visiting the following link: Emergency Resources.

Video Introduction

The video below offers a one-minute demonstration of how Supportiv works.

How to Use Supportiv & Your EAP

On-Demand Webinars

Below, Team Members can watch on-demand webinars from Supportiv.

From Burnout to Motivation

How to Advocate for What You Need

Mental, Emotional & Social Growth

Download the Presentation